Sailing in the Mediterranean? Discover the Mediterranean boating and yachting regulations of European countries: France, Monaco, Italy, Spain, Gibraltar, Croatia, Montenegro, Greece, Turkey, Cyprus, Slovenia and Malta.

FRANCE

Documents. Passport. Yacht registration papers. VAT receipt or other proof of payment. You may be asked for: proof of insurance for the yacht, proof of competence to handle a yacht such as the RYA ICC.

Customs (Douane). France, as part of the EU, comes under EU legislation regarding the payment of VAT. Non-EU boats must report to customs on arrival in France. The non-EU temporary importation of a yacht is carried out under a Titre de Séfour obtained at major customs offices.

A yacht registered in a country that does not have a special financial arrangement with France (most do but those that do not include Australia, New Zealand, South Africa and flags of convenience such as Panama, Liberia, Honduras and the Maldives) must pay an additional charge while in French harbours.

When it was introduced the tax caused a mass exodus of boats from French marinas which left many of the locals out of work. An unofficial edict from Paris cancelled implementation in practice, but it still remains law.

Entry formalities. EU flag yachts on which VAT has been paid or which are exempt can enter France from other EU countries without formalities. Random checks are carried out by customs.

Non-EU flag yachts should report to customs and immigration at the first major port of call. Here you will be stamped into the country and a record of your entry made. An inventory of yacht equipment and crew lists will be required.

Yachts chartering in France must have proof VAT (TVA) has been paid on the charter boat and VAT must be paid on the charter fee. Private EU yachts can change crews (including the skipper) as long as no fee is paid for the use of the boat.

Other regulations. Black Water New restrictions on black water effectively prohibit discharge of untreated sewage less than 12M offshore. Some ports require yachts to have holding tanks. Fines for discharging black water may be levied.

MONACO

Entry formalities.Report to Direction des Ports (Monday—Friday) or Pilot Station (Saturday—Sunday) within 24h. French Customs operate in Monaco. Notify the Pilot Station on departure (or on the previous day if between 2300— 0800).

Other laws. Monaco Harbour. All vessels leaving the harbour have priority. Max speed 3 knots. All vessels must be able to manoeuvre at all times. Any works affecting manoeuvrability must be reported to the Port Authority. It is forbidden to leave vessels unmanned.

ITALY

Documents. Passport. Yacht registration papers. VAT receipt or other proof of payment. Insurance papers which must have an Italian translation for proof of third party liability and serial numbers of tender and outboard.. You may be asked for proof of competence to handle a yacht such as the RYA ICC or Yachtmaster’s certificate.

Customs (Guardia di hinanza). Italy as part of the EU comes under EU legislation regarding the payment of VAT.

Non-EU boats should report to customs on arrival in Italy.

Entry formalities. EU yachts on which VAT has been paid or which are exempt can enter Italy from other EU countries without formalities. The old Constituto in arrivo per il naviglio di diporto has been shelved for EU- registered yachts with EU nationals on board.

Non EU- registered yachts or non-EU nationals should report to the first large port in order to clear into the country with the relevant authorities and apply to the harbourmaster for a Costituto (an entry declaration) at the first port.

Yacht Tax 2012 The yacht tax proved universally unpopular and was repealed in 2013 for foreign flag vessels.

Other laws

- It is against Italian law to swim in any Italian harbour. Swimmers are subject to hefty fines.

- It is against Italian law to motorsail within 300m of the shore, except when entering or leaving a harbour.

- Anchoring is prohibited anywhere around the coast within 200m of a beach or within 100m elsewhere.

This rule can often be seen to be flouted, particularly during the high season, but it is a law which is increasingly being enforced, and can attract a fine of €350.

SPAIN

Documents. Passport. Yacht registration papers. VAT receipt or other proof of payment. You may be asked for a radio licence, proof of insurance for the yacht and proof of competence to handle a yacht such as the RYA International Certificate of Competence (ICC) or Yachtmaster’s certificate. Insurance papers must have a Spanish translation of the Third Party agreement.

Customs (Aduana). Spain as part of the EU comes under EU legislation regarding the payment of VAT. Non-EU boats must report to customs on arrival in Spain.

Entry formalities. EU flag yachts on which VAT has been paid or which are exempt can enter Spain from other EU countries without formalities. Random checks by customs are carried out. Non-EU flag yachts should report to customs and immigration at the first port of call. Here you will be stamped into the country and issued with a special form. An inventory of yacht equipment and crew lists will be required.

Other regulations.Black water New restrictions on black water effectively prohibit discharge of untreated sewage less than 12M offshore. Some ports require yachts to have holding tanks. Fines for discharging black water may be levied.

GIBRALTAR

Documents. Valid passport. Yacht registration papers. Radio licence.

Customs. Formalities may now be completed at either of the marinas. Yachts not using a marina currently have no way to clear in.

Entry formalities. A yacht should fly a ‘Q’ flag and head for a marina. A number of forms for customs, immigration and harbour officials must be completed. A list of crew and passengers is required in triplicate. The following regulations should be noted:

- Any crew member or passenger intending to reside ashore during the time the vessel is in port must report to immigration control at Waterport police station and give the address ashore;

- Immigration control should be advised of any guests residing aboard

- If any person has employment in Gibraltar it must be reported to the immigration office;

- Crew must not be paid off or enrolled (regardless of nationality) without permission from the immigration office;

- Before leaving report to the immigration office at Waterport the time and date of departure;

CROATIA

Croatia joined the EU on 1 July 2013. It

is in line with EU Immigration and VAT rules, although it is not part of the

Schengen Area. Reports that customs demanding proof of VAT paid status is

causing problems for UK yachts. See RYA for latest www.rya.org.uk

Documents. Passport. Yacht registration papers. Proof of ownership/authorisation. Insurance papers. Proof of VAT status. Proof of competence.

Crew List.Foreign registered yachts must declare a Crew List on entering Croatia. It includes crew and passengers. The list must be re-submitted each time the list changes. If there are no changes made, a yacht has no need to check in with the authorities until departing Croatia.

List of Persons. Foreign registered yachts must declare a List of Persons when replacing crew or passengers in Croatia. The maximum number of people on the list may not exceed 230% of the registered maximum for that vessel. The list must be re-submitted each time the list changes, but should not include children under the age of 12. The number of changes is not limited.

Evidence of Seaworthiness. In accordance with the country of the vessel’s flag. Harbourmaster may perform an inspection of the vessel.

Entry formalities. All yachts entering Croatia should fly the Q flag and the Croatian courtesy ensign. Yachts approaching Croatia should monitor VHF Ch 16 and expect to be called by patrol vessels.

On entering Croatia, yachts must proceed to a port of entry. Immigration, customs, and the harbourmaster are visited.

All persons on board must also register with the police for the duration of the stay. In practice this can be done in the harbourmaster’s or marina office.

Ports of entry

Permanent Ports of Entry: Umag, Zadar, Porec, Sibenik, Rovinj, Split, Pula, Vela Luka, Ploce, Rijeka, Ubli (Lastovo), Mali Losinj, Metkovic, Senj, Korcula, Dubrovnik (Gruz)

Seasonal Ports of Entry(from 1 April to 30 October): ACI Marina Umag, Novigrad, Sali (Dugi Otok), Bozava (Dugi Otok), Primosten (Kremik), Starigrad (Hvar), Komiza (Vis), Vis (Vis), Cavtat

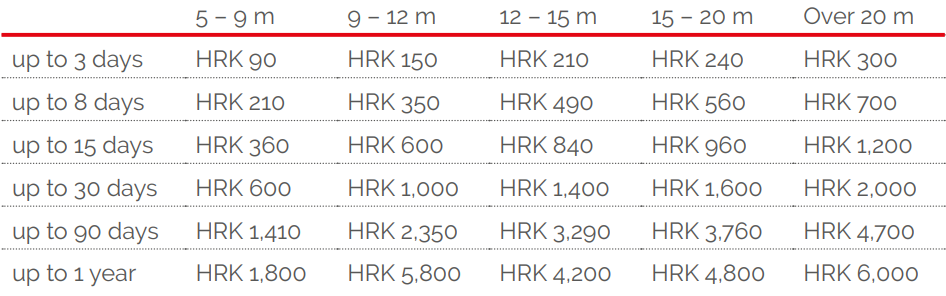

Cruising Tax. Following Croatia’s accession to the EU the old Vignette has been replaced by the Navigation, safety and pollution prevention fee. Changes have been proposed to the Cruising Tax (incorporating the Sojourn Tax) from Jan 2018.

The Sojourn Tax Fee. The vessel owners or users pay the sojourn tax for themselves and all persons spending the night on that vessel on a lump sum basis. In this sense, a vessel is every vessel over 5 m in length with built-in beds, which is used for rest, recreation or cruising, and which is not a nautical tourism vessel.

The lump sum of the sojourn tax is paid by sailors prior to the departure of the vessel in the harbourmaster’s offices or branch offices, or in nautical tourism ports, when they stay overnight in nautical tourism ports or at a berth in the nautical part of a port open for public transport.

Harbourmaster offices or branch offices or nautical tourism ports shall issue a sojourn tax receipt to sailors who have paid the sojourn tax in the lump sum.

The lump sum of the sojourn tax for sailors depends on the length of the vessel and the time period for which sailors purchase the sojourn tax. The invoice for the paid sojourn tax must always be on the vessel and the master of the vessel must present it at the request of an authorized person.

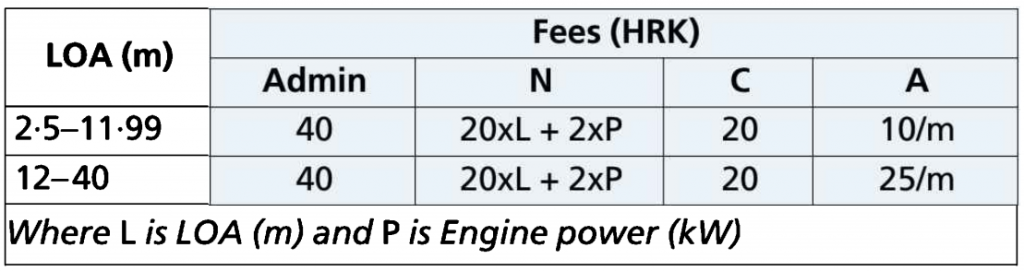

Skippers are also required to pay fees as shown below: an Admin fee, the navigation safety fee (N), the maritime chart fee (C) and the aids to navigation fee (A).

So for a 13m yacht with a 60kW engine there will be an additional 40+380+20+325 = 765HRK to pay.

Other regulations

When underway, motor boats and sailing boats must not navigate within 50m of the coast. Rowing boats may navigate at a distance less than 50m from the coast. When near beaches, all boats shall navigate at a distance greater than 50m from the enclosure of the marked bathing area i.e. 150m from the coast of a natural beach. The Croatian tourist board has a nautical guide that is free to download on their website, www.htz.hr

All fishing in Croatian waters requires a permit which can be obtained from the harbourmaster.

MONTENEGRO

Documents. Passport. Visas are no longer required by most nationals for stays of up to 90 days. Yacht registration papers. A radio licence, proof of insurance and some proof of competence may be asked for.

Customs. A yacht must report to a Port of entry when entering Montenegrin waters.

Entry formalities. Call Bar Radio on entering Montenegran waters. A listening watch on VHF Ch 16, 24 is recommended. On arrival at a port of entry call Bar Radio on VHF Ch 16, 24.

On first entering a port of entry you must report to the harbour office, customs and frontier police. The Vignette is proof of clearance, light dues and administration fees and should be displayed. Costs for 12m yacht:

- €29 – one week

- €77 – one month

- €221 – one year

(more than double for multihulls and motorboats)

Other Regulations. Swimming is strictly prohibited outside of marked zones.

GREECE

Documents. Passport. Yacht registration papers. VAT receipt or other proof of payment. You may be asked for proof of competence to handle a yacht such as the RYA ICC.

Customs (Telenion). Greece as part of the EU comes under EU legislation regarding the payment of VAT.

Entry formalities. All yachts entering Greek waters should fly a Greek courtesy ensign. Entry formalities will depend on the flag of the vessel and the nationalities of the crew. This will determine whether it is necessary to visit a port of entry where all the relevent officials will be found.

- Arrivals from outside the Schengen area are no longer obliged to use a port of entry, but must notify the port police in advance (usually on VHF Ch12) and provide two completed signed copies of the new Pleasure Boat’s Document on arrival. Any harbour with a port police presence can be used.

- Non EU registered yachts must obtain a Transit log from Customs officials.

- Non EU passport holders must complete immigration formalities and obtain visas if necessary.

If a full check in is required, a port of entry should be chosen and the authorities should be visited in the following order:

- Immigration Passports, visas

- Customs VAT, Transit log

- Port police PBD, TPP, DEKPA

Pleasure Boat’s Document (PBD). This is a pro forma crew list. One completed copy is retained by the port police on entry to Greece, the other stamped copy must be kept on board at all times. It should be handed in to a port police office when leaving Greek waters.

Note It appears that this document is no longer required by EU vessels.

Traffic Document (DEKPA). All yachts over 7m LOA must purchase a Traffic Document (DEKPA) from the Port Police. The DEKPA must be stamped by the port police annually.

This will likely happen on entry to Greece or on launching, when the TPP is paid (see below). It may be checked at any time and can be re-used even after the yacht has left and re-entered Greece. The cost of the DEKPA is €50.

Ports of entry

- Ionian: Kerkira (Corfu), Preveza, Argoostoli (Kephalonia), Zakynthos

- Peloponnese: Katakolon, Pflos, Kalamata

- Gulf of Patras: Patras

- Saronic Gulf: Zea Marina, Glyfada, Vouliagmeni Marina

- Argolic Gulf: Navplion

- Cyclades: Ermodpolis (Siros)

- Northern Greece: Volos, Thessaloniki, Kavala, Alexandropolis

- Eastern Sporades: Mirina (Limnos), Mitilini (Lesvos), Kos, Pithagorion (Samos), Vathi (Samos)

- Dodecaneese: Kalimnos, Kes, Rhodes

- Crete: Chania, Iraklion, Agios Nikolaos

The new Greek tax was ratified at the beginning of 2014. It is likely to be implemented soon, but as yet is not being collected (Oct 2018). Payments will be made via a bank or local tax office. The receipt should be kept with the DEKPA and PBD.

Transit Log

The Transit Log is a customs record for non-EU yachts visiting the EU. It is now valid for 18 months, and an extension for up to six months may be applied for. A yacht may be left in Greece for as long as the Transit Log remains valid. Your passport will be stamped by customs to indicate that the vessel remains in Greece. The Transit Log must be surrendered when the yacht leaves Greece. In addition, all non-EU registered yachts (except those from the EEA) are subject to a Reciprocal Tax of €15 per metre, every three months, levied at the end of the period. This tax will likely be dropped when the TPP is in operation.

Other documents

Yacht registration papers will usually be requested. Proof of VAT status, insurance cover, radio licenses and certificates of competence may also be requested.

Marinas and boatyards at a Port of Entry will usually assist with the paperwork.

Insurance

You need a certificate stating the amounts for which you are covered and this is required to be carried on board the yacht. Contact your insurance company and they will be able to provide the necessary documentation including a Greek translation.

Greek insurance requirements:

- All yachts must have insurance for liability for death or injury for those on board and any third party for a minimum of €500,000.

- Insurance for liability for damage of at least €150,000.

- Liability for pollution resulting from an incident of €150,000.

Yacht damage and salvage. If your boat is damaged, either through your own devices or by a third party, and it is reported to the port police, they are obliged to constrain your yacht until it is proved to be seaworthy.

In these cases, the port police will usually require that you have your boat surveyed by a registered yacht surveyor and this can cost anything from €500-1000. Without the survey the port police cannot release your boat. If at all possible try to resolve smaller matters without going to the port police. In major cases of salvage your insurance company will be involved and will employ a surveyor in any case.

TURKEY

Documents Passport. Most foreign nationals, including UK citizens, need to obtain a visa. Yacht registration papers. You may be asked for proof of insurance and proof of competence to handle a yacht such as the RYA ICC or Yachtmaster’s certificate.

Entry formalities A yacht entering Turkish waters for the first time must do so at a designated Port of Entry. A ‘Q’ flag and a Turkish courtesy flag should be flown.

You will have to visit the health office, passport police, customs and harbourmaster, usually, but not always, in that order. The Transit Log can be requested at any port or on demand from the Sahil Guvenlik (Coastguard).

Note Yachts registered in Cyprus may not enter Turkish waters.

Ports of entry: Istanbul, lzmir, Bodrum, Finike, Ta§ucu, Bandirma, Kusadasi, Datca, Kemer, Mersin, Canakkale, Cesme, Bozborun, Antalya Iskenderun, Ayvalik, Didim, Marmaris, Alanya, Dikili, Gulluk, Fethiye Turgutreis, Kas

Customs. A Transit Log will be issued by customs and it costs US$30. It is valid for one year, or one continuous visit, or until the yacht is laid-up, whichever happens first. On issue you must list your intended itinerary and crew list in the Transit Log, and changes to either must also be recorded and authorised by the harbourmaster at the time of the change.

When leaving Turkey with the yacht you must surrender the Transit Log, even if you intend to return to Turkey at any time. Foreign flag yachts with the owner aboard can have friends or relatives aboard. If anyone leaves this must be noted on the Transit Log.

If new friends arrive a new Transit Log must be purchased. A foreign flag yacht without the owner aboard can enter Turkey and sail to another port to pick the owner up, but cannot change the complement of those on board.

New harbour dues must be paid on entry to Turkey for vessels over II NRT (this equates to yachts around 10-12m LOA). The dues are around 7TL for vessels up to 45NRT.

The payment process can only be done by an agent who may also complete all clearance procedures at the same time. Agent charges vary from €35-150 so ask around before committing to one agent, and make sure you know what is included. It is possible to complete clearance procedures yourself, up to the payment process.

It may be helpful to carry proof of NRT if your vessel is under 11NRT, as otherwise the harbourmaster will assess your NRT.

Light dues must also be paid by larger vessels over 30NRT. Again tonnage certificates would be helpful.

Visa regulations. Sticker-type visa stamps are no longer issued on entry. All those who require a visa must apply for an e-visa online before arriving in the country. The visa is multi-entry and costs US$20 for a UK citizen. You must have a passport which remains valid for at least six months beyond the end of the visa period: www.evisa.gov.tr/en/

All EU, N American and Australasian citizens receive 90 days. South Africa passport holders get just 21 days.

- Maximum stay in Turkey is 90 days in a 180 day period (i.e. you must be out of the country for at least 90 days in every six month period).

- Multiple entries into Turkey within the 180 day period are permitted on the same visa (as long as the total days spent in Turkey do not exceed 90 days). i.e. the 90 days do not have to be consecutive

- Those who need to stay for longer should apply for a Turkish Residence permit

Residence permit costs:

| Permit validity | Cost (US$) |

| 1 month | 25 |

| 3 months | 35 |

| 6 months | 50 |

| 1 year | 80 |

| Requirements |

- a current transit log

- a residence permit book (US$80)

- 6 colour passport photos

- a copy of passport, showing identification page, and most recent entry stamp

- original passport

- a completed application form

Notes

- Short term residence permits no longer require a marina contract or a bank account.

- Heavy fines are imposed for over-staying your visa, even by one day.

- Permits can be obtained by EU and US nationals and no doubt by some other nationals as well.

Recent changes to the regulations suggest that residence permits can be cancelled if the holder remains outside Turkey for a cumulative period of more than 120 days in the previous 12 month period.

It may be possible to reapply if you are planning to stay longer than 90 days in any 180 day period, but enquire well in advance to avoid heavy penalties for overstaying your visa limit. Most marinas are very helpful to those needing assistance.

Other regulations

Blue Card (Mavi Kart).The new scheme governing the discharge of black and grey water.

- All boats are required to have a blue card. This can be obtained from all marinas.

- There are no plans to inspect individual foreign flag yachts to see if they have adequate tankage.

- Monitoring of the blue card will be carried out by the harbourmaster and the coastguard.

- In the Fethiye-Goqek area yachts were required to present evidence of a pump-out to obtain a new Transit Log.

- There are pump-out stations in the marinas and these work efficiently. A charge is made for pump- out, usually 15—20TL.

- Grey water is still included in the SEPA regulations although there is still plenty of boat washing and outdoor showering going on. All the Goqek charter companies use ecological brand detergents, as should everyone. It should be evident that any yachts away from a pump-out station for more than a few days will have filled the holding tank. Here you can draw your own conclusions as to what happens in practice.

Note Large fines are levied on yachts discharging waste into the sea, particularly in harbour. The maximum official fine is in the region of €235-310. However fines have been known to be as much as €620 and, in one case, €1,550.

Chartering. Foreign flag yachts can charter in Turkey if registered with an authorised Turkish charter operator and on payment of the requisite fees for registration. Charter yachts entering Turkey (inevitably from Greece) must pay a substantial charter fee (depending on LOA) to cruise around the Turkish coast.

Mobile phone registration. Turkish authorities are clamping down on illegal/stolen mobile phones. If you wish to use a Turkish SIM card in your UK handset you must register your mobile phone’s IMEI number with customs officials when you enter Turkey.

You are advised to carry proof of ownership. Failure to register it will mean your phone may cease to work after a few days.

In practice this can be done at most Turkcell shops in major (tourist) towns where the procedure is well understood.

CYPRUS

Documents Passport. Yacht registration documents.

Customs Southern Cyprus: Rules on temporary importation and VAT are in line with EU regulations.

Entry formalities Southern Cyprus: A yacht should make for Paphos, Limassol or Larnaca. Southern Cyprus is part of the EU and is in line regarding movement of EU-registered vessels.

Customs and immigration are located nearby at ports of entry.

In Limassol,St Raphael Marina and Larnaca Marina, they are located within the marina. A yacht coming from northern Cyprus may be denied permission to enter southern Cyprus and you may be liable for the penalties mentioned below.

Note

- The government in southern (Greek) Cyprus considers any visit by a yacht to northern (Turkish) Cyprus to be illegal. It should be pointed out that under UN Resolution 34/30 (1979) and 37/253 (1983) the UN views the Government of Cyprus (i.e. presently southern Cyprus) as the legal government of all Cyprus. If a yacht does visit northern Cyprus and then goes to southern Cyprus it can incur heavy penalties. Under the laws of the Republic of Cyprus a fine of up to €17,086 and/or two years imprisonment can be imposed. It is legal to proceed from mainland Turkey directly to southern (Greek) Cyprus.

- Check in procedures out of hours are subject to a €60 surcharge.

- Reunification talks are ongoing.

SLOVENIA

Documents Passport. No visas are required for EU nationals for stays of less than three months Yacht registration papers. A radio licence and proof of insurance may be asked for.

Customs. A yacht must report to a Port of entry when entering Slovenian waters.

Ports of entry: Koper, Piran (permanent), Izola (seasonal, from 1 May to 31 October).

Entry formalities Sailing permit costs are limited to a small payment for light dues. Around €30 for a 10-12m yacht.

MALTA

Documents. Passport. Yacht registration documents. You may be asked for proof of insurance for the yacht and a radio licence.

Customs. As part of the EU, Malta comes under EU legislation regarding VAT. All non EU yachts coming from outside Maltese territorial waters must make for Valletta harbour or Mgarr to clear customs. The EU pet passport scheme now applies in Malta, and so pets with the correct official paperwork may enter Malta from another EU country.

Pets on yachts may have special requirements and enquiries should be made well in advance.

Entry formalities. A yacht entering Malta should fly a ‘Q’ flag and a Maltese maritime courtesy ensign (not the same as the national flag). When 10M off Malta call Valetta Port Control VHF Ch 16, 12 to advise them of your arrival. They will usually ask you to call again when you are one mile off to receive instructions. Depending on where you are the following customs clearance procedure applies.

Mgarr, Gozo. Berth where directed and clear in. If you arrive at night berth where possible and clear in in the morning.

Grand Harbour. If you call in on VHF as you should then you will be directed to go to Grand Harbour. The situation at Grand Harbour is far from convenient with only a very high quay to tie up on if you cannot get on the lower sections of quay used by the customs boats.

You will need several crew lists. Customs procedure is thorough yet polite. EU yachts with EU crew arriving from an EU country may be permitted to berth at a marina and clear in afterwards.

Source: Mediterranean Alamanac 2019-20 / imray.com